FOR ALL AGES

When it comes to planning your children’s lives, you’ve probably spent time researching the best choices for them in terms of their diet, their schooling and their social life. But have you spent time thinking about securing their financial future, as well as your own? According to a 2020 study conducted by the Money and Pensions Service, 48% of the adult population admitted they had worried about money once a week or more in the previous month, while a huge 71% of 18-24 year olds said they worry about money at least once a week.

It’s hardly surprising - there’s so much information out there that putting a financial plan in place can seem completely overwhelming and too time-consuming, especially when juggling raising kids, working, and all the other challenges of daily life. But with Claro Money, the UK’s first digital financial coaching app, you’re just a few taps away from changing all that. Not only is it a brilliant budget tracker, it also gives you access to real-life, personalised support from a financial expert who can help you easily plan, save and invest your money.

Claro Money is a new subscription-based app launched in 2021 that aims to empower its users to become money-smart. Claro Money allows you to easily track your spending, get real-life financial coaching, build a financial plan and start saving and investing towards your goals. The app also has easy-to-read resources to help boost your confidence.

People use personal trainers to get themselves in shape, so why not go to a personal financial coach to get your finances in tip-top condition too? Seeking expert help may seem out of reach, but Claro Money believes that financial expertise should be accessible to all, so that everyone can be armed with the knowledge they need to make good financial choices.

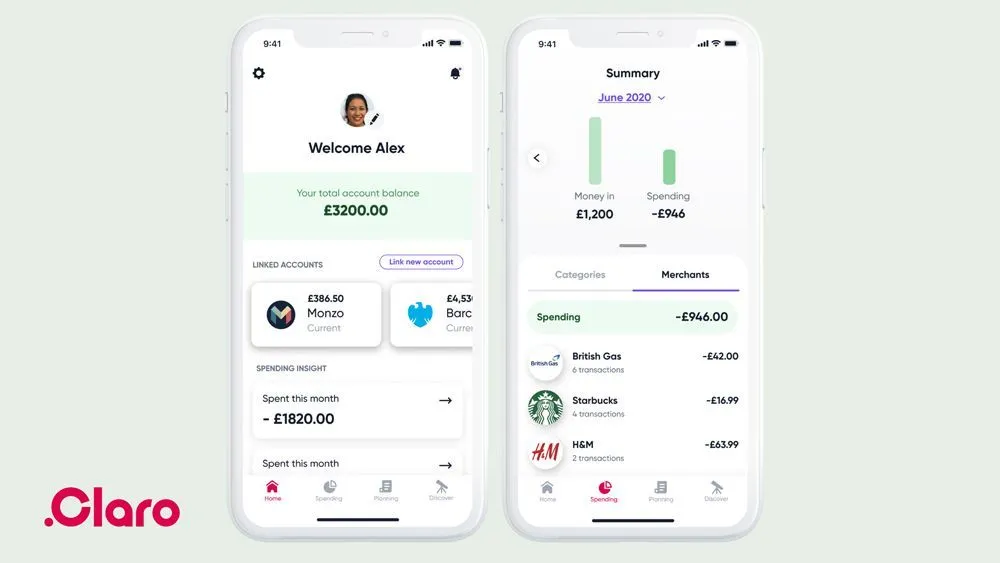

You just need to download the app, connect your bank accounts and get started.

Through Claro Money, you’ll connect your bank accounts via open banking and use this information to see where your money is being spent. There’s no limit to the number of accounts you can link, so the more accounts you connect to the app, the more accurate your analysis will be.

After you’ve connected your bank accounts you’ll have an overview of all your finances. Claro Money’s advanced technology will allow you to accurately track and analyse your spending by sorting your transactions into categories. In fact, its categorisation technology is so accurate that it automatically categorises over 70% of all transactions, compared to the industry average of only 30%. From this point, the budgeting insights will help you figure out where you may want to make changes.

For another layer of spending analysis you can use Claro Money’s Savings Index, which is available on the website. The Savings Index shows how your everyday expenses add up over time, rating each outgoing with a value. The higher the number, the bigger chance you have to save. These outgoings can be anything from recurring phone contracts, insurance plans and TV subscription services, to slightly more sporadic expenses like buying coffee on your way to work, or ordering a takeaway from Deliveroo as a treat. With the Savings Index, you can see an overview of your expenses and how each of them are weighted against each other, allowing you to decide where you may be able to put your money towards other things instead; namely, your financial goals.

Perhaps your ultimate end goal is to buy a house, so you’re saving up for a deposit. You might notice that the Savings Index for your mobile phone contract is particularly high. So, you research and discover that you’ve already paid off your handset, and at £55 per month you’re now massively overpaying. You switch to a SIM-only contract and cut your monthly phone bill by more than 50% to £20 per month. With that, your index drops and you’re cutting £420 of costs a year, which is £420 extra that you can now put into savings.

Using the Savings Index, you’ll dive into your past finances and use them to inform your plan for the future.

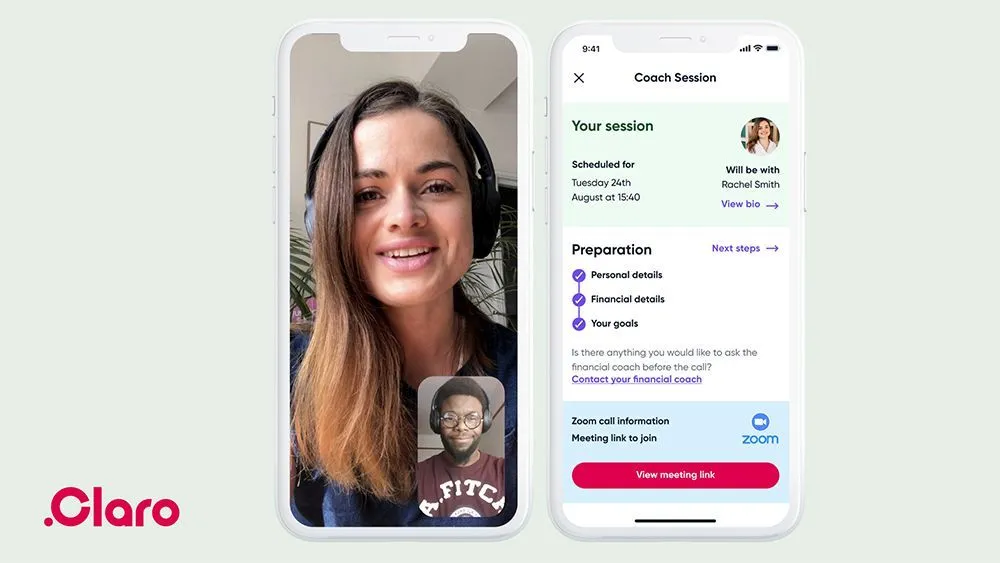

Discussing money can be intimidating, but using the Claro Money app, you can easily book a free 1-2-1 session via video call with one of its certified financial coaches from the comfort of your own home.

Before your call, you will be asked to provide some information relating to your personal situation. You’ll answer questions relating to your income, expenses, assets, liabilities and goals. Providing these details in advance allows your coach to prepare the session and meet you with a clear overview of your current circumstances.

If you’ve already given your coach the information they asked for, you don’t need to bring anything else to the session, though it would be useful to have things like your savings account balances and pension information at hand. You can come prepared with questions for your coach too. Bear in mind that Claro Money does not give tax advice, so any tax-related questions cannot be answered in extreme detail.

Together, you’ll discuss your finances and devise a plan to take control of your money and achieve your financial goals; whether that’s saving, investing, or just making smarter spending choices in your daily life. During the call you can work with your coach to set your actions directly in the Claro Money app, or do it yourself once the call has ended. Whatever your next steps are, you’ll see a summary of them displayed in the app as goals.

Your privacy is of the utmost importance to Claro Money. No information or details from the call are ever shared with anyone outside of Claro Money without your permission. Claro Money always aims to improve its services, so calls are recorded for both training and monitoring purposes.

Not only will you have access to a personal finance coach, but you’ll also be part of a supportive online community that offers a safe space for discussions you might not typically be comfortable having with friends and family offline. Through Claro Money’s social pages you’ll motivate each other to reach your goals and stick to your budgets.

Spending money is such an integral part of our lives, but financial plans can never be one-size-fits-all, which is why having expert help is useful. Whether you’re saving for your first house, you’re trying to figure out childcare costs, or you’ve just changed to a single-income household, your unbiased coach will work with you to create a productive, attainable plan going forward, and the Claro Money community will support you as you progress.

There’s a distinct lack of financial education provided at school, so most people enter the world of adulthood with minimal knowledge of anything money-related. Luckily, the Claro Money app offers helpful, beginner-friendly guides on tons of subjects, including how to start investing and how to save for retirement. There’s even more useful content on the website too, including ‘the Claro guide to adulting’, which teaches you all you need to know about everything from budgeting and insurance, to paying into a pension, and buying your first home.

According to Perkbox’s financial wellbeing study, the top three causes of financial stress in UK adults are not having enough savings for emergency or unexpected costs, the pressure of not falling behind the people around you financially, and worrying about how to hit big financial goals in the future, like buying a house. Claro Money offers guides that cover these topics and provides you with the foundations for good financial literacy.

There are tons more useful pieces of in-app and web content too, including live Q&As and webinars.

All content is clear and concise, with minimal technical jargon, so that you can learn effectively and grow confident with your financial knowledge.

When investing, your capital is at risk.

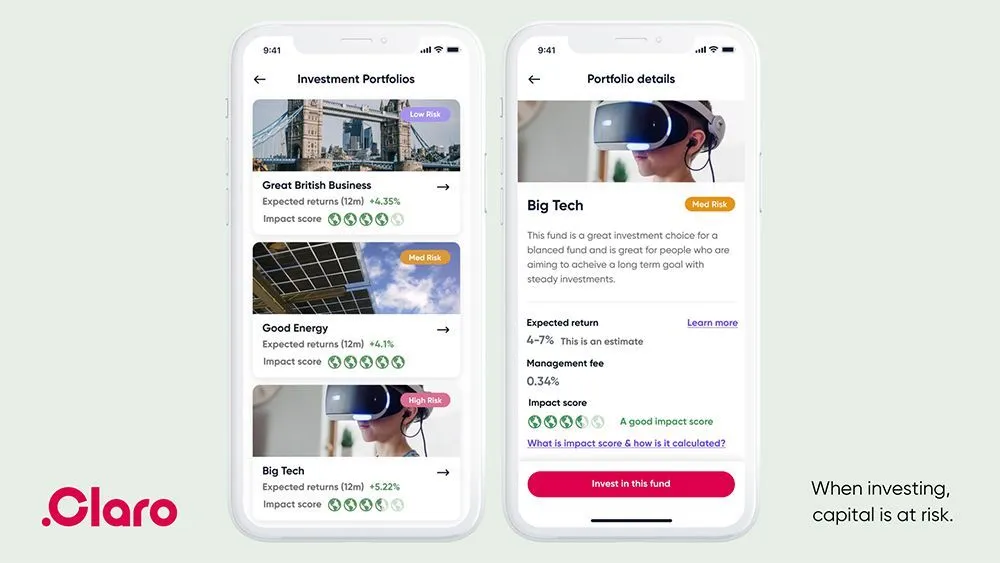

Along with its financial coaching service and budget tracking, Claro Money offers other financial products, including investment options. You can open a Claro Money Stocks and Shares ISA and a General Investment Account with just £10.

According to the Financial Lives 2020 survey conducted by the Financial Conduct Authority, while 77% of UK adults hold some sort of savings account, only 33% of the adult population hold investment products, even though over 80% of the adult population has investable assets. Perhaps unsurprisingly, older adults invest and save at disproportionately higher levels than their younger counterparts.

But why do most adults — particularly those below the age of 55 — with disposable income avoid investing? Simply put, investing is notoriously confusing for beginners. The sheer quantity of information and jargon out there means the process is at best, overwhelming, and at worst, misunderstood to the point that new investors inadvertently make poor financial decisions with their investing. Not only this, but people often see investing as something that only the super-rich can afford to do; that you must need huge amounts of money to start.

Claro Money is there to bridge the gap and make investing accessible to everyone, regardless of your financial situation. It provides tailored support and coaching to help you learn how to invest responsibly, in line with your own circumstances.

Claro Money offers a variety of investment services and products depending on your financial goals, personal values and desired risk level. If you’re looking to open a portfolio, your financial coach can explain these investment options to you.

Currently you can choose from nine hand-picked themed investment portfolios at three risk levels, depending on your goals and values. The investment team is always looking behind the scenes for better options for Claro Money users, and makes sure to rebalance the portfolios whenever the market changes. There are also no platform fees for investments up to £2,500.

For people who value sustainability and social responsibility in their financial choices, Claro Money offers ESG information on all portfolios. You can see the impact of your investments with Claro Money’s Impact Score and use it to choose the best ethical investment for you.

Choose from the eco-friendly Good Energy portfolio, socially responsible Conscious Lifestyle, USA-focused American Allstars, and more, all filled with carefully curated companies to invest in.

So whether you want to put money into tech giants, home-grown businesses or clean energy, you can start investing with as little as £10, and always have convenient access to your money whenever you need it.

Claro Money has a goal to protect one million trees by the end of 2021. It intends to do this by protecting 25 trees in the Amazon every time a potential new customer signs up to its waiting list.

Firstly, the Claro Money app offers a unique combination of both human and technological expertise. You have access to advanced technology that provides you with detailed analysis of your finances, with real financial coaches filling any human-sized gaps in the algorithms.

Second, in general, Claro Money has a focus on teaching good habits and providing long-term support from start to finish, which is why its experts are financial coaches, not advisors.

A traditional financial advisor typically only works with people who have large sums of money available, and charges a percentage of your assets. With Claro Money, you will be given the same up-to-date tools and information whether you have £10 available, or £100,000.

Claro Money’s coaches have financial expertise, and they can provide support, helpful information and all the tools you need to succeed, all from a screen you keep in your pocket. As with any coach, they provide knowledge and tips to ensure you adopt a smart money mindset, supporting you throughout each stage of the journey. They lay the foundations for healthy habits so that you can continue to make empowered financial decisions in years to come.

Disclaimer:

Our website offers information about budgeting, planning, savings and investments, but never personal recommendations. If you’re not sure what financial products are right for you, including investments, then please seek professional financial advice from an authorised financial advisor.

Past performance is not necessarily a guide to future performance and the performance of investments is not guaranteed. If you do decide to invest please remember that investments can go up and down in value, so you could get back less than you put in and your capital is at risk. This article does not contain any personal recommendations for a particular course of action, service or product. Before subscribing for any services offered by Claro Money, please read the Terms & Conditions document.

Claro Money is the UK's first financial coaching app. It helps you to track your spending, and gives you access to certified financial coaches who can help you get on top of your finances and make your money work for you. With Claro Money, you can take control of your money and achieve your financial goals.

Read The Disclaimer

At Kidadl we pride ourselves on offering families original ideas to make the most of time spent together at home or out and about, wherever you are in the world. We strive to recommend the very best things that are suggested by our community and are things we would do ourselves - our aim is to be the trusted friend to parents.

We try our very best, but cannot guarantee perfection. We will always aim to give you accurate information at the date of publication - however, information does change, so it’s important you do your own research, double-check and make the decision that is right for your family.

Kidadl provides inspiration to entertain and educate your children. We recognise that not all activities and ideas are appropriate and suitable for all children and families or in all circumstances. Our recommended activities are based on age but these are a guide. We recommend that these ideas are used as inspiration, that ideas are undertaken with appropriate adult supervision, and that each adult uses their own discretion and knowledge of their children to consider the safety and suitability.

Kidadl cannot accept liability for the execution of these ideas, and parental supervision is advised at all times, as safety is paramount. Anyone using the information provided by Kidadl does so at their own risk and we can not accept liability if things go wrong.

Kidadl is independent and to make our service free to you the reader we are supported by advertising.

We hope you love our recommendations for products and services! What we suggest is selected independently by the Kidadl team. If you purchase using the buy now button we may earn a small commission. This does not influence our choices. Please note: prices are correct and items are available at the time the article was published.

Kidadl has a number of affiliate partners that we work with including Amazon. Please note that Kidadl is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.

We also link to other websites, but are not responsible for their content.

Was this article helpful?

We’ll send you tons of inspiration to help you find a hidden gem in your local area or plan a big day out.

Check your inbox for your latest news from us. You have subscribed to:

Remember that you can always manage your preferences or unsubscribe through the link at the foot of each newsletter.